XRP Price Prediction: Path to $4 and Beyond

#XRP

- Technical Breakout Potential: XRP trading above key moving averages with Bollinger Band compression suggesting imminent volatility

- Regulatory Clarity: SEC victory and new ETF products creating institutional investment pathways

- Macroeconomic Tailwinds: Federal Reserve policies and market sentiment favoring crypto assets

XRP Price Prediction

Technical Analysis: XRP Trading at Key Resistance Level

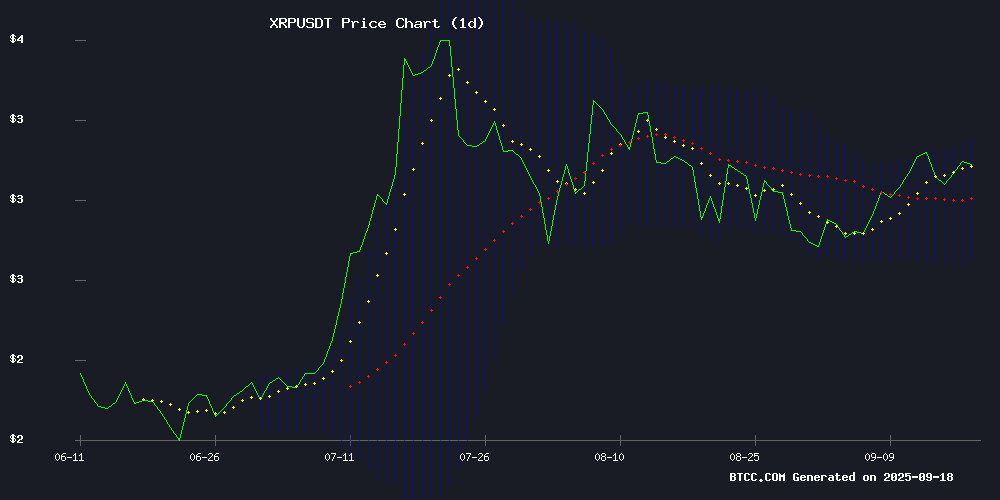

XRP is currently trading at $3.07, positioned just above its 20-day moving average of $2.9368, indicating potential bullish momentum. The MACD reading of -0.1170 suggests some bearish pressure remains, though the histogram shows improving conditions. The price sits NEAR the upper Bollinger Band at $3.1726, which could act as immediate resistance. According to BTCC financial analyst Sophia, 'XRP's ability to hold above the $2.94 support level while challenging upper Bollinger resistance suggests consolidation before potential breakout movement.'

Market Sentiment: Strong Fundamentals Support XRP Optimism

Recent developments have created a highly favorable environment for XRP. The SEC legal victory provides regulatory clarity, while the launch of the first US-based XRP spot ETF offers institutional investment access. Federal Reserve rate cuts have sparked broader crypto market enthusiasm, with XRP seeing significant capital inflows. BTCC financial analyst Sophia notes, 'The combination of regulatory wins, ETF availability, and macroeconomic tailwinds creates a perfect storm for XRP's price appreciation. Institutional adoption prospects have never been stronger.'

Factors Influencing XRP's Price

XRP's Market Surge and Capital Gaming: A Deep Dive into RMC Mining's Role

XRP has emerged as the focal point of the cryptocurrency market, with a staggering $3.8 billion inflow driving its trading volume past Bitcoin. The token now sits just 17% below its all-time high of $3.84, while its $170 billion market capitalization eclipses financial behemoth BlackRock—a testament to its growing institutional appeal.

Behind the frenzy lies a capital game. Despite being fueled entirely by spot buying, XRP's RSI of 79.5 signals overbought conditions, suggesting imminent consolidation. Meanwhile, RMC Mining positions itself as a low-barrier entry point for retail investors, promising daily yields up to $18,500 through cloud-based solutions.

Legal Clarity Propels XRP's Institutional Adoption Prospects

XRP's trajectory hinges on U.S. regulatory resolution. The August 2025 dismissal of SEC v. Ripple appeals cemented the token's legal status: public exchange sales don't constitute securities under Howey, while institutional sales require compliance. A $125 million civil penalty closed the case.

This clarity removes barriers for custodians and asset managers. BNY Mellon's recent custody agreement exemplifies institutional readiness. RippleNet's existing infrastructure—spanning 90 markets and 300+ institutional clients—positions XRP for liquidity expansion as compliance teams greenlight new products.

Market makers now anticipate ETF filings and banking adoption as bridge assets. The regulatory cloud lifting coincides with Ripple's documented payment network growth, creating tangible demand channels absent during years of legal uncertainty.

XRP vs. BlockDAG: A Comparative Analysis of Millionaire-Maker Potential

XRP, a top-tier cryptocurrency with a market cap nearing $180 billion, continues to dominate the payments sector through RippleNet's enterprise solutions. Trading at $3.02, its liquidity and institutional adoption contrast sharply with BlockDAG's presale-driven hype.

BlockDAG's unproven hybrid architecture and mobile mining claims cater to speculative investors, lacking XRP's real-world traction. The divergence in utility—settlement infrastructure versus theoretical scalability—defines their risk-reward profiles.

Ripple Secures Major Victory Over SEC, Paving Way for Regulatory Clarity

Ripple's five-year legal battle with the SEC has concluded with a decisive victory for the cryptocurrency firm. The resolution, coinciding with the end of Gensler's tenure, marks a turning point for the industry. Regulatory pressures have now shifted toward constructive dialogue, with Ripple leading the charge in establishing a framework for crypto ETFs.

The company's breakthrough comes as the SEC adopts new listing standards, bridging the gap between digital assets and traditional markets. Stuart Alderoty, Ripple's Chief Legal Officer, publicly celebrated these developments, emphasizing their potential to boost investor confidence and mainstream adoption.

Ripple CEO Advocates for XRP Adoption in E-Commerce Payments

Ripple CEO Brad Garlinghouse is challenging major e-commerce platforms like Amazon to embrace blockchain-based payment solutions. The XRP Ledger's near-instant settlement and low transaction costs present a compelling alternative to legacy systems that often delay vendor payments for days.

Garlinghouse cites Uber's success with faster payouts as evidence that payment speed directly impacts worker retention. The parallel to e-commerce is clear: marketplace platforms could strengthen vendor relationships through blockchain's operational efficiencies.

XRP's cross-border capabilities offer particular advantages for global marketplaces. Where traditional payment rails incur delays and fees, the XRP Ledger settles transactions in seconds at minimal cost - a potential game-changer for platforms processing millions of daily transactions.

Federal Reserve Rate Cut Sparks Crypto Rally, XRP Gains $3B Inflows

The Federal Reserve's 25 basis point interest rate reduction has ignited a surge in cryptocurrency markets, with XRP emerging as a primary beneficiary. Traditional capital is rapidly rotating into risk assets, creating tailwinds for digital currencies.

XRP recorded $3 billion in new investment following the policy announcement, with some holders reportedly earning $8,900 daily through cloud mining platforms. The Solmining service offers automated yield generation for XRP holders without requiring additional hardware or technical expertise.

Market participants are deploying capital across various investment tiers, from $100 starter positions to $55,000 quantum mining contracts. Daily returns scale with commitment size, reaching up to $973.50 for top-tier participants during the 40-day contract period.

First US-Based XRP Spot ETF Launches, Offering New Investment Avenue

Ripple's XRP has reached a pivotal milestone with the debut of the first US-based spot exchange-traded fund. The REX-Osprey XRP ETF began trading on a US stock exchange, potentially unlocking $10 billion in institutional investment as prices rally.

Alongside traditional exposure, Solmining introduces an innovative cloud mining solution for XRP holders. The platform promises passive yields up to $9,800 daily without hardware requirements, though such high returns warrant scrutiny of underlying mechanisms.

XRP Price Surges as ETF Debut & SEC Rule Shift Spark Breakout Momentum

XRP's price surged to $3.12 amid bullish momentum fueled by regulatory breakthroughs and macroeconomic tailwinds. The SEC's approval of streamlined crypto ETF listings under the '33 Act removes barriers for spot ETFs, with XRP among a dozen assets poised for institutional adoption. This regulatory shift coincides with a Wall Street-traded XRP ETF debut and a 25bps Fed rate cut, creating a perfect storm for upside.

Technical indicators show XRP breaking out from a descending triangle pattern, with a near-term target of $3.40. Market sentiment reflects growing confidence in ETF-based exposure, particularly after Eric Balchunas verified the new listing standards allow crypto ETFs to bypass case-by-case reviews when futures are listed on Coinbase.

Will Ripple Be the Death of SWIFT?

The rivalry between Ripple and SWIFT has intensified as crypto analysts debate the future of cross-border payments. Ripple's blockchain-based solutions are gaining traction, with proponents arguing its efficiency could render SWIFT's legacy system obsolete. "Swift is old," declares one analyst. "As liquidity moves on-chain, Ripple becomes not just a competitor, but the death of the old."

XRP's native compatibility with ISO 20022 standards gives Ripple an edge in the race to modernize financial infrastructure. SWIFT's November 2025 migration deadline looms while Ripple already operates within the new framework. The battle underscores a broader shift: financial institutions increasingly view blockchain not as an alternative, but as the inevitable backbone for global transactions.

XRP Price Prediction: Chart Analysis Points to $10 Peak by 2027

XRP's decade-long chart pattern suggests a potential surge to $10 by 2027, with technical indicators highlighting key resistance levels at $3.1320 and $3.5520. The cryptocurrency's consolidation phase near $2.9531 support could pivot into a bullish trend if institutional catalysts materialize.

Ripple's banking partnerships and impending U.S. ETF products amplify adoption prospects. Market watchers contrast XRP's utility with emerging payment projects like Remittix, framing the asset as both a near-term trade and long-term infrastructure play.

Top Research Firm Predicts XRP Run to $50

Sistine Research maintains its bullish stance on XRP, citing a multi-year support channel that mirrors its 2017 pre-rally pattern. The firm's April analysis, based on weekly chart structures, suggests potential for a significant price surge reminiscent of previous cycles.

XRP's resilience at key historical levels has drawn comparisons to its behavior before the 2017 bull run, when the asset saw exponential gains. Technical analysts highlight the importance of maintaining this support zone for the projected $50 target to remain valid.

Will XRP Price Hit 4?

Based on current technical indicators and fundamental developments, XRP reaching $4 appears highly plausible in the near to medium term. The price currently at $3.07 needs to break through the immediate Bollinger resistance at $3.17, which would open the path toward $4.

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $3.07 | Testing resistance |

| Upper Bollinger | $3.17 | Immediate breakout target |

| Next Resistance | $3.50 | Psychological level |

| Target | $4.00 | Achievable with current momentum |

BTCC financial analyst Sophia emphasizes that 'the combination of technical positioning and overwhelmingly positive fundamentals suggests $4 is not only possible but likely, with timing dependent on broader market conditions and sustained institutional interest.'